Black Panthers in Aptos

The late 1960s and 1970s were a tumultuous time in America. The Vietnam War, serial killers, Civil Rights marches and the Black Power Movement were plastered across the nightly television news. Aptos was to get our own, very up-close-and-personal incident with the Black Power movement.

Reviewing your investments

As we are writing this month’s article, the Dow Jones Industrial Average just crossed over 22,000 for the first time in history (Aug. 2, 2017). Year to date the Dow Jones Industrial Average is up approximately 11.4 percent while the S & P 500 is up approximately 10.61 percent (as of Aug. 1, Source: Morningstar).

Addressing Fireworks in our Neighborhoods and Beaches

With Memorial Day and the unofficial start of summer the number of complaints for fireworks begins to increase.

Finding out your home's value | SERGIO ANGELES Prime Home Loans

Want to know what your house is worth? Log on

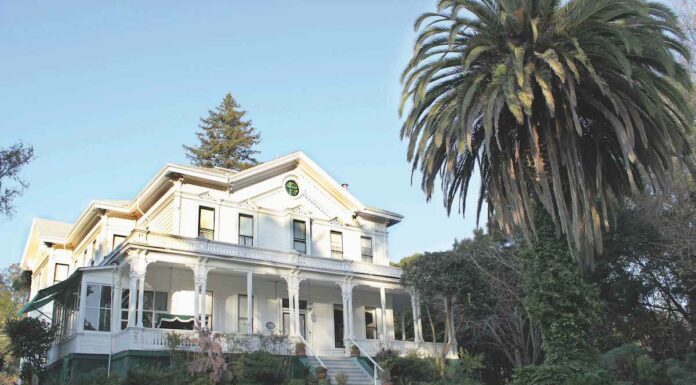

The historic Mangels House

Mangels House is an elegant, Victorian, summer mansion in the Aptos hills, built by Claus Mangels, brother-in-law of Claus Spreckels, the sugar millionaire. It is the last remaining example of three nearly identical mansions built between 1872-88.

Claus Mangels was born Sept. 12, 1832, in...

Ask Nicole: The many faces of positive parenting

There’s a Chinese proverb, “A journey of a thousand miles begins with one step.” It makes me think of the Triple P – Positive Parenting Program motto, “Small changes, big differences.” Together, both quotes provide a helpful reminder that in this lifelong journey called “parenting,” the greatest growth and change often comes from taking one small step at a time.

Water, water everywhere | History Corner

Every winter, the people who live and work in the flats of Rio Dell Mar experience flooding in the streets and in their yards. Every winter, news reporters descend on the area to cover the events. This year, one reporter asked me about the...

The water of life, part two

There are a lot of colorful names to describe suppliers of illegal booze: Rum runners (self-explanatory), moonshiners, bootleggers. What is a bootlegger? In the late 1800s, it was illegal to give Native American Indians whiskey, so traders would conceal flasks of liquor in their boot tops.

Previously, we learned how prohibition helped to fund organized crime, and how otherwise law-abiding people developed a thirst for "medicinal" Scotch whiskey. But, Scotch alone does not make a well stocked bar, and not all alcohol was smuggled into the county. Gin was actually the most common liquor consumed during prohibition and much of it was produced locally.

APTOS History Corner

Before Rancho Del Mar and Safeway came to Aptos, that property was used for growing sugar beets and cauliflower. State Park Drive was lined on both sides with huge cypress trees. Highway 1 was a four-lane highway with no overpass or on-and-off ramps. Aptos was a small town but was getting ready for a growth spurt and the Cabrillo College Aptos campus was just being planned.

County facts and budget highlights

The Board of Supervisors recently completed our budget hearings and as part of the hearings we received reports from departments about their goals for the coming year based on Board priorities.