Breaking the 'cycle'

The holiday season has come and gone and many are left with the familiar feeling of regret after months of lack of exercise and overeating. They feel tired, sluggish, and yes, out of shape and over-weight ... again.

This is what we call the "Holiday Weight Cycle." The problem is that fad diets and extreme exercise routines are often a “go-to” for most people; sometimes they work, but usually they don’t. For most these extreme measures are not sustainable and lead only to frustration or failure. For example, when one "starves" themselves or abruptly starts a daily, high-intensity exercise regimen it often leaves them feeling defeated and they quit; hence the "cycle" continues. The problem isn’t that people don’t have enough will-power, it's the "System" itself. As a society we tend to set unrealistic expectations which pressures individuals to give into unhealthy behaviors such as this "Holiday Weight-Cycle." Will 2018 be your year for change? Or will this cycle leave you one year farther from your goal to be healthy and fit again?

Improvements to Aptos Creek Road and The Village area

By Zach Friend, Santa Cruz County Supervisor

If you’ve been driving on Soquel near the Aptos Village recently you’ve noticed the work on the intersection of Aptos Creek Road and the surrounding area. This work includes important pedestrian improvements as well as intersection and drainage...

Ask Nicole: We are all Michelle Obama

I recently listened to Michelle Obama’s book, Becoming. I was fascinated by her life and the depth of skills and experience she had before becoming the First Lady.

Aptos Real Estate Recap

Aptos is a very special place to live and work and I look forward to the second half of 2017!

Water, water everywhere | History Corner

Every winter, the people who live and work in the flats of Rio Dell Mar experience flooding in the streets and in their yards. Every winter, news reporters descend on the area to cover the events. This year, one reporter asked me about the...

Serving you on County and Regional Commissions

Santa Cruz County Supervisor Zach Friend holds his son Elliott while speaking at the Aptos Chamber of Commerce's monthly breakfast meeting on Jan. 11. Friend touched on topics such as transportation, traffic and housing, mentioning that residents have to earn $70,000 a year to afford a two-bedroom apartment in Santa Cruz County. He encouraged residents to get involved and "choose the type of community you want," rather than pass on responsibility to future generations. "You may feel like, individually, you cannot make a significant difference on the way the community's trajectory will go," Friend said. "But I also know that if each one of us even did something small, the sum of all of those things will be more change than any of us would ever have been able to envision." Friend was also recently appointed chair of the Board of Supervisors. Photo by Jeanie Johnson

90 years of serving the community

The Aptos Chamber was more like a small-town improvement association. The initial name was the Aptos Community Club. The first item of business was to get a fire engine for the town and to obtain all night telephone service. The next item of work was to celebrate the opening of the new bridge into town which replaced an old wooden bridge with a suicide curve in the middle. The chamber planned the ceremony and a big parade.

Paying taxes: A matter of perspective

Happy New Year, Readers. It’s time to say ‘tis the Season. No, not that season—it’s TAX SEASON!

Tax season involves long hours at the office with little to no time for anything other than work. But it also become a time of year where gratitude...

Aptos History Corner | Everyone Loves a Parade

The 4th of July is America’s birthday and many communities have parades to celebrate that fact. The freedom to determine our own future was at the center of the founding of our country.

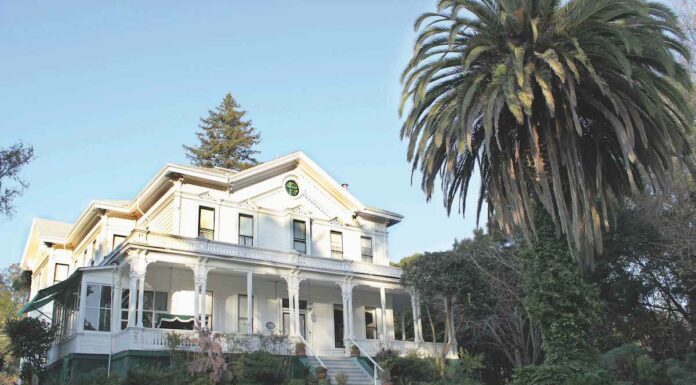

The historic Mangels House

Mangels House is an elegant, Victorian, summer mansion in the Aptos hills, built by Claus Mangels, brother-in-law of Claus Spreckels, the sugar millionaire. It is the last remaining example of three nearly identical mansions built between 1872-88.

Claus Mangels was born Sept. 12, 1832, in...